Some Known Details About Short-term Loan Canada

Table of Contents7 Easy Facts About Short-term Loan Canada DescribedShort-term Loan Canada Things To Know Before You Get ThisThe 9-Minute Rule for Short-term Loan CanadaThe Ultimate Guide To Short-term Loan CanadaLittle Known Facts About Short-term Loan Canada.The smart Trick of Short-term Loan Canada That Nobody is Discussing

The calculations and amortization routine created are: (i) based upon the precision as well as efficiency of the information you have actually gotten in, (ii) based upon presumptions that are thought to be practical, and also (iii) for estimate functions only as well as ought to not be depended upon for certain monetary or other guidance. When you make your credit application, rates of interest might have transformed or might be different because of information contained in your application.

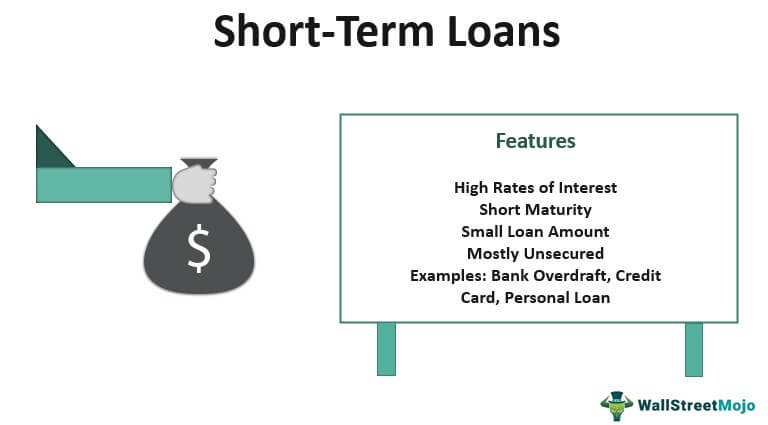

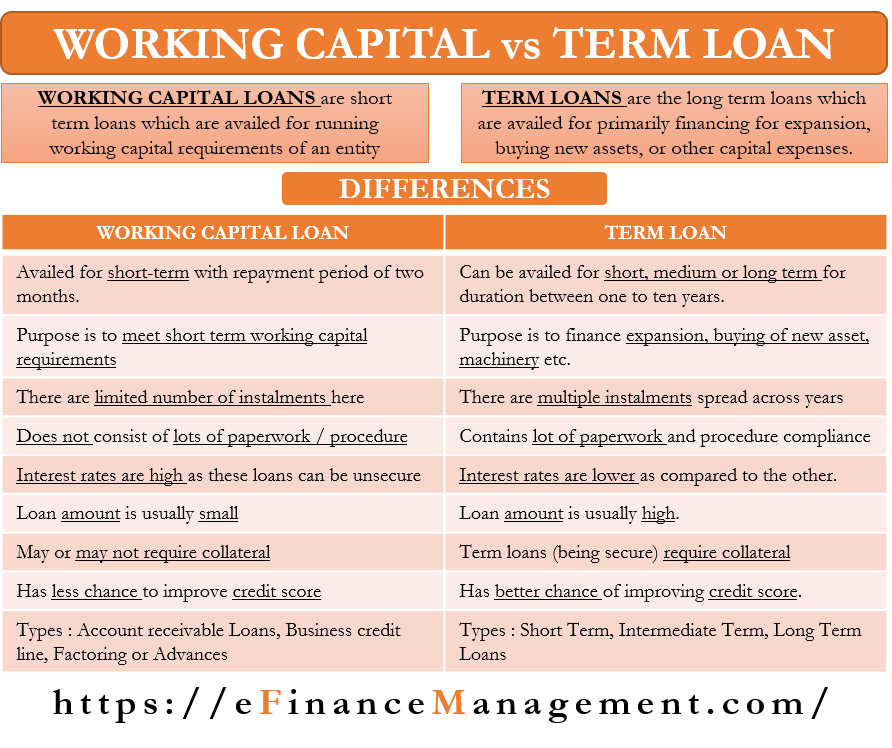

They are unsecured car loans, implying that you don't require to protect your finance versus your house or automobile or any type of other home. If you get a short-term loan you are called for to repay the very same amount each month to the lender until the lending as well as the rate of interest are repaid.

6 Easy Facts About Short-term Loan Canada Shown

9% You after that are required to pay back 178. After the 3 months you will certainly have paid back a total amount of 534. At Cash, Woman, we make locating a short-term finance quick and easy.

We then offer your application to the 30+ lending institutions on our panel to find the loan provider more than likely to accept your application, at the very best APR offered to you. We will certainly then route you right to that lenders web site to finish your application. Our solution is cost-free and thanks to our soft search innovation has no influence on your credit history.

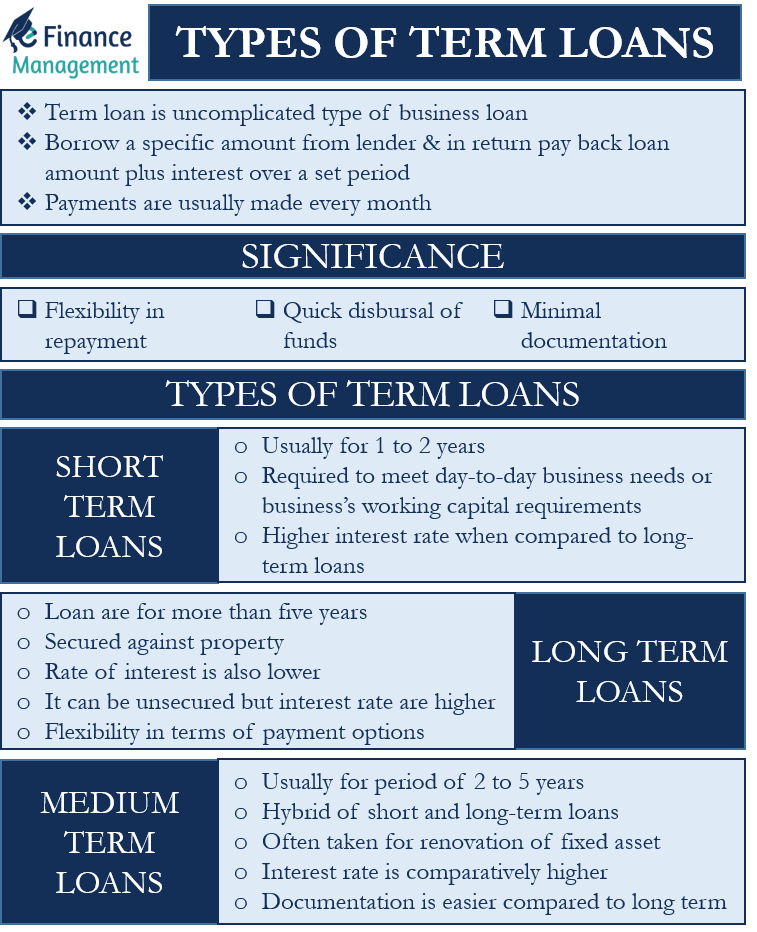

By contrast, a short-term loan is spread out over 2 or more months. For many individuals, spreading out the expense over several months makes the car loan repayments more inexpensive.

The smart Trick of Short-term Loan Canada That Nobody is Discussing

How Short-term Loan Canada can Save You Time, Stress, and Money.

If you are contrasting car loans online, you may discover that the interest prices on short term lending items look high when contrasted to headline financing prices advertised by high road financial institutions or constructing cultures. One key reason for this is that brief term lending institutions cater to offering to those with bad debt accounts or no credit report in all.

This danger is handed down to the clients in the kind of a higher rates of interest. If you stop working to satisfy your repayments after that yes, your credit score can be negatively influenced. Although this is true of any kind of car loan or credit rating item, not simply short-term financings. Alternatively, if you meet all your payments completely and also on time after that this website here can indicate that you can be depended handle credit rating well as well as might increase your credit report.

If you fulfill all these standards, after that of course you are qualified to use. If you are having problem with your funds as well as anxious regarding your financial obligations after that there are a number of organisations that you can look to free of charge as well as objective recommendations. See the links below.

Indicators on Short-term Loan Canada You Need To Know

Payday advance loan are short-term loans of approximately $1,500 supplied in exchange for a post-dated paycheque or various other pre-authorized debit that the loan provider utilizes for future settlement of the finance, plus any kind of interest and also charges. If the payday car loan is not settled promptly, it can lead to more interest and costs. short-term loan canada.

If you borrow $500 for a cash advance lending, you can be billed up to $75 in interest as well as costs. This may not appear like a whole lot page of money, my latest blog post however the brief period of a cash advance loan indicates they have a lot higher rate of interest costs than other sorts of financings.

Let's compute what a cash advance car loan can cost you. Claim that: The amount of your next paycheque will be $1,000 You wish to take out a cash advance for $300 The cost to borrow the car loan is $45 The overall price to settle the lending is $345. That indicates the quantity you will certainly obtain from your next paycheque will be $655.

The Buzz on Short-term Loan Canada

Payday lenders are regulated in B.C., meaning any kind of firm that supplies cash advance finances need to be certified as well as follow laws established by the rural government. You can check to see if a firm is accredited with this. Business should also present the permit anywhere it offers payday advance loan, whether online or in-person.

If you have concerns or concerns with a cash advance or loan provider, get in touch with Consumer Defense BC.

If high rising cost of living is squeezing your spending plan, you aren't alone. 6 per cent, lots of Canadians are turning to loans to pay for requirements.